Fascism and the Hollowing Out of America

In the early 2000s, business in Florida was booming. The housing market was on fire, home values skyrocketed, real estate agents had more clients than they could handle, and mortgage lenders were practically throwing money at anyone with a pulse. I was running a business at the time, and my clients, many of whom worked in real estate, paid me regularly with checks from their commissions or earnings in the industry. It all seemed like a golden age. That is, until one day, my bank suddenly refused to accept my deposits. The reasoning? The checks I was bringing in were from real estate professionals, and the bank had deemed real estate too risky. That moment was the first domino to fall.

The Housing Bubble and Its Corporate Architects

The housing bubble was no accident. It was the product of government sponsored entities like Fannie Mae and Freddie Mac, which, through reckless policies, inflated home values beyond reason. These institutions, along with major Wall Street firms, enabled an era of risky lending, where loans were issued to borrowers who had no ability to repay them. Subprime mortgages, bundled into mortgage backed securities and sold off as lucrative investments, gave the illusion of a perpetually rising housing market. This artificial inflation created by political and financial elites was a classic example of Mussolini’s fascist corporatism; a system where government and corporate interests fuse into a singular power structure, operating in unison at the expense of the public.

Fannie and Freddie were central to this system, backstopped by implicit government guarantees that encouraged recklessness. When the market could no longer sustain itself, the entire house of cards collapsed. But while everyday Americans lost their homes, their savings, and their jobs, the financial institutions responsible for the disaster were bailed out. The banks, the investment firms, and the government sponsored mortgage giants (those at the center of the scheme) were too big to fail. Meanwhile, small businesses like mine, the homeowners who had been misled, and the working class were left to fend for themselves.

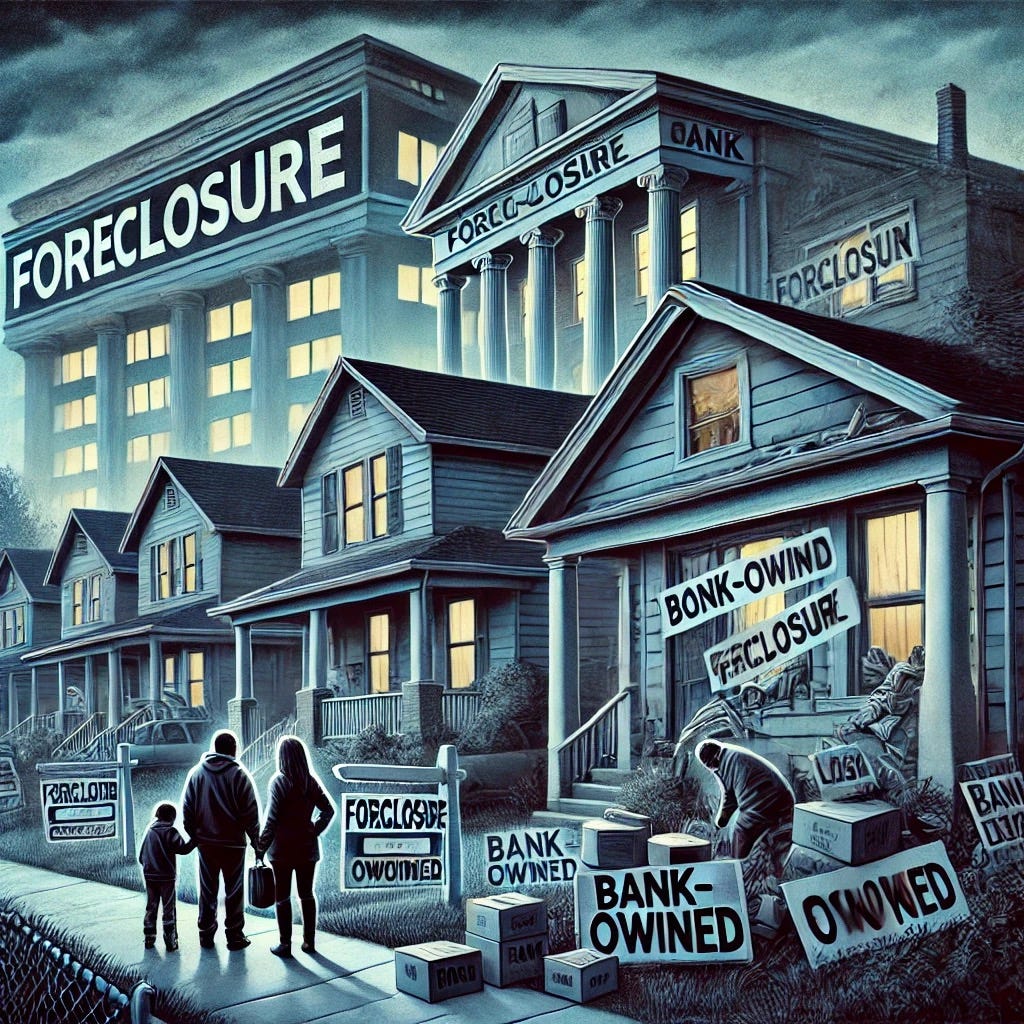

Recession, Foreclosures and the Erosion of American Wealth

When the housing market crashed, it wasn’t just a crisis of real estate, it sent shockwaves through the entire economy. The foreclosure crisis swept through the country, wiping out families’ savings and leaving once thriving neighborhoods full of abandoned homes. Banks tightened credit, businesses struggled, and job losses followed in rapid succession. The service economy dried up, consumer spending shrank, and wages plummeted. It was a vicious cycle.

To make matters worse, the banks who had recklessly inflated home prices and handed out toxic loans, found a new way to profit from the crisis they created. Instead of working with struggling homeowners to restructure loans, they rushed to foreclosure. Once they seized the homes, they dumped them onto the market at rock bottom prices, selling them AS IS to hard money investors for cash. These investors, often hedge fund and institutional buyers, scooped up foreclosed properties at a fraction of their former value.

Since home values are based on comparable sales in a given area, this process had a devastating impact on homeowners who had not defaulted. Prime borrowers and people who owned their homes outright watched helplessly as their property values plummeted. A house that had been worth $300,000 before the crash suddenly had a neighboring foreclosed home sell for $100,000 to an investor looking to flip or rent it. This artificial suppression and doctoring of home values wiped out years, sometimes decades of hard earned equity. It was another form of wealth transfer, where average Americans lost everything while banks and institutional investors scooped up assets for pennies on the dollar.

Outsourcing and the Destruction of the Middle Class

As the foreclosure crisis devastated homeowners, another economic betrayal was unfolding: the incentivization of offshore outsourcing. With American workers already struggling, the federal government continued subsidizing corporations that moved jobs overseas. Tax breaks, trade agreements like NAFTA, and an unrelenting push for globalization ensured that when American workers needed jobs most, the jobs were nowhere to be found.

In the information technology sector, thousands of highly skilled American professionals were forced into a humiliating position: train your cheaper foreign replacements or lose your severance package. Many corporations brought in foreign labor under H-1B visas. Cheap, compliant, and willing to work for a fraction of an American salary. It was economic warfare against the American middle class, orchestrated by the same power structures that had profited off the housing bubble.

This wasn’t just bad luck or unfortunate market cycles, it was a deliberate restructuring of the economy to benefit a small elite at the expense of the working class. The American Dream had been hijacked by corporate and political interests that saw people not as citizens, but as disposable labor and debt slaves.

Nostalgia and the Political Disillusionment

Looking at the political landscape today, I find myself reminiscing about the time I truly began to detach from politics. The collapse of the housing market and the gutting of the American workforce forced me to confront a difficult truth: both parties (Republican and Democrat) had become complicit in this economic destruction. Each side played its role in enabling corporatism, through the globalist economic policies that put foreign labor markets ahead of American workers.

This realization led me toward anarchism and the conclusion that the state itself is not the solution but the problem. Government interventions had created the housing bubble, government bailouts had shielded the guilty, and government incentives had ensured that jobs would never return to American workers. It wasn’t just about bad policy; it was systemic.

The world today feels eerily similar to that pre-2008 period. Covid felt similar (more on that another time). The same financial games are being played, the same corporate-government alliances remain intact, and once again, people are being led to believe that good change is coming. But history has already shown us how this ends. As for me, the scars of the last two economic disasters remain and my disillusionment with the system has only grown deeper.

Where were you when the real estate bubble burst and recession began?